Leveraging Generation-Skipping Trusts: Tax Efficiency and Asset Protection

Estate planning is a critical aspect of financial management that ensures the efficient transfer of assets to the next generation while minimizing tax liabilities and safeguarding those assets from third-party creditors. One powerful tool in the estate planning arsenal is the Generation-Skipping Trust (GST), which serves as a strategic vehicle for both tax optimization and asset protection.

Introduction

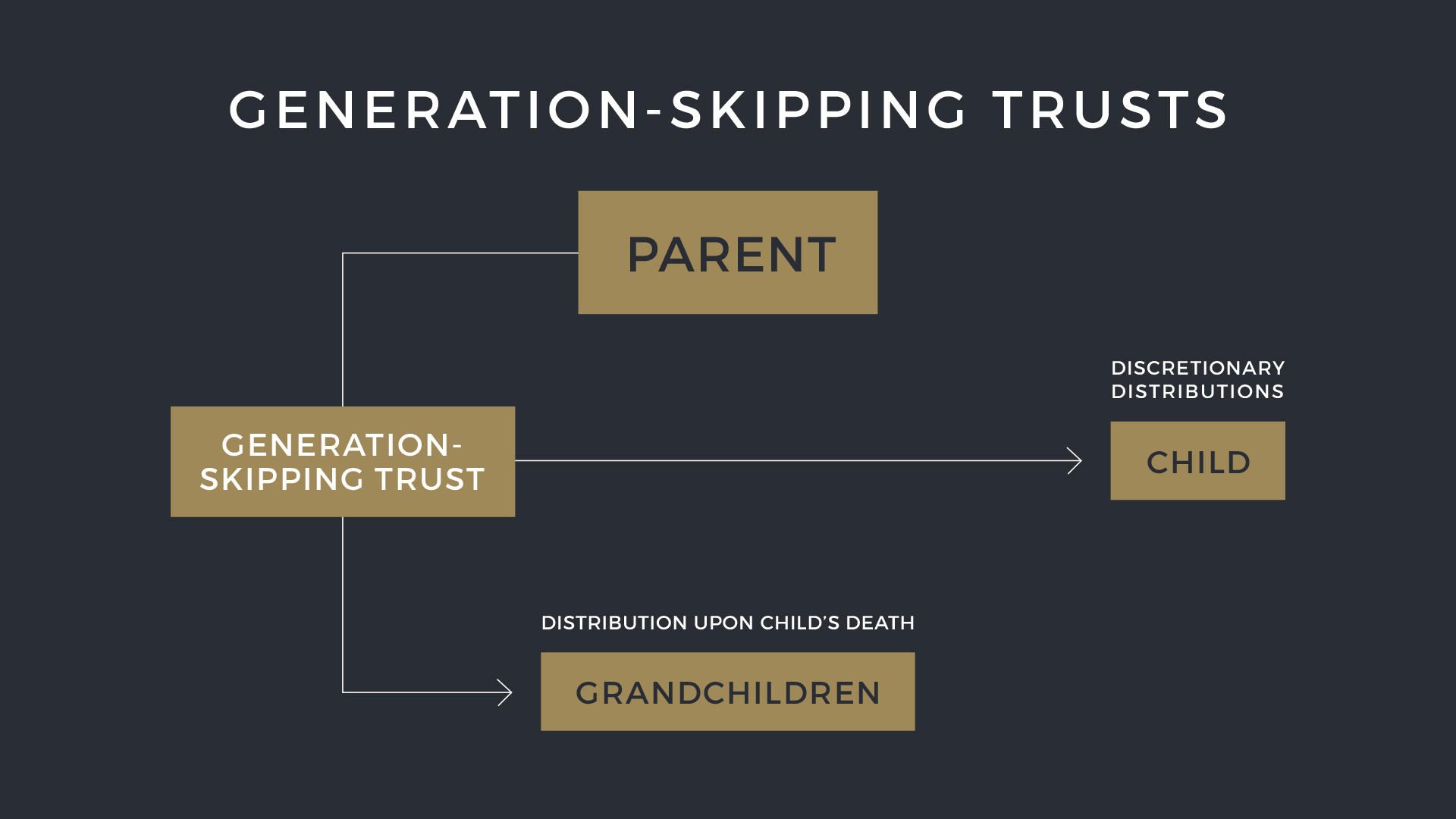

A Generation-Skipping Trust is an estate planning instrument designed to transfer wealth from one generation to another, typically skipping one generation, such as grandchildren, to leverage certain tax advantages and protect trust assets from potential liabilities. Here's a closer look at why someone might use a GST for these purposes:

1. Tax Efficiency

A primary motivation for creating a GST is to minimize estate taxes, specifically the federal generation-skipping transfer (GST) tax. The GST tax is levied on transfers of substantial assets to individuals who are more than one generation younger than the donor (e.g., grandchildren or great-grandchildren). Without proper planning, these transfers can incur both estate tax and GST tax, leading to a significant reduction in the transferred assets.

By utilizing a GST, individuals can allocate their wealth strategically to skip a generation and reduce or even eliminate GST tax liability. Assets placed in a well-structured GST can grow outside the taxable estate, providing a tax-efficient way to preserve wealth for future generations.

2. Asset Protection from Creditors

Another compelling reason to establish a GST is asset protection. Trusts offer a level of protection against creditors and third-party claims that direct gifts or bequests may not provide. Assets placed in a GST are held separately from the beneficiaries' personal assets, making them less vulnerable to claims from creditors, lawsuits, or divorcing spouses.

This feature can be particularly valuable in safeguarding the family's wealth and ensuring that the intended beneficiaries receive their inheritances intact, even if they encounter financial difficulties or legal disputes.

3. Control and Flexibility

Generation-skipping trusts also provide a degree of control and flexibility over the distribution of assets. Grantors can establish specific guidelines for when and how the trust assets are distributed to beneficiaries. This control allows for the protection of assets from beneficiaries who may not be financially responsible or mature enough to handle substantial wealth.

Additionally, grantors can appoint trustees who have the expertise to manage the trust assets and make discretionary distributions based on the beneficiaries' needs and circumstances.

4. Legacy Preservation

For many individuals, a GST serves as a means of preserving their family's legacy. By protecting assets from potential creditors and taxation, they can ensure that their wealth endures for future generations. This legacy can encompass financial security, educational opportunities, and the ability to pursue long-term family goals and philanthropic endeavors.

Conclusion

In the realm of estate planning, the Generation-Skipping Trust offers a dual benefit of tax efficiency and asset protection. By utilizing this powerful tool, individuals can strategically transfer wealth to their grandchildren or subsequent generations, reduce tax liabilities, and safeguard those assets from third-party creditors and potential legal entanglements. While the intricacies of GSTs require careful planning and professional guidance, they can be an invaluable component of a comprehensive estate plan aimed at securing a lasting financial legacy for generations to come.