What’s an AB Trust?

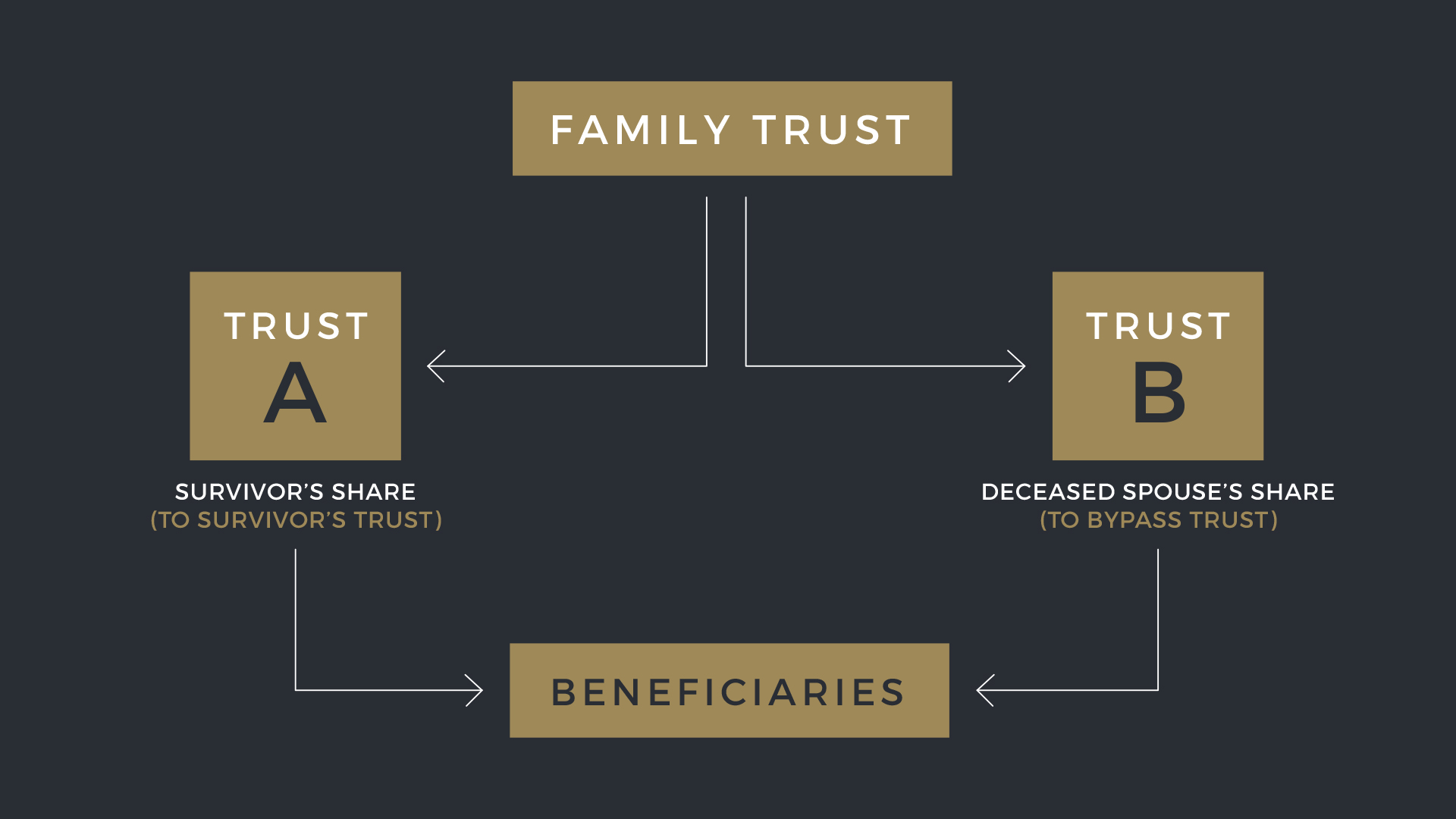

When a married couple in the United States creates an estate plan, one common tool they may use is an AB trust, also known as a bypass trust or a credit shelter trust. This type of trust is designed to help the couple minimize estate taxes and ensure that both spouses’ assets are protected after one spouse dies.

Under an AB trust, when the first spouse dies, their assets are transferred into the trust, rather than passing directly to the surviving spouse. The surviving spouse may still have access to the trust assets, but they do not own them outright. Instead, the assets are held in trust for the benefit of the surviving spouse, as well as any other beneficiaries the couple has designated.

One important feature of an AB trust is that it can help protect the couple’s community property. Community property refers to assets that are owned equally by both spouses, such as income earned during the marriage, jointly-owned bank accounts, and real estate purchased together. In some states, such as California, community property laws apply to married couples, meaning that both spouses have an equal claim to these assets.

When one spouse dies, their community property is typically transferred to the surviving spouse, who becomes the sole owner. However, if the couple has an AB trust, the deceased spouse’s share of the community property is transferred into the trust instead. This means that the surviving spouse cannot give away or dispose of the deceased spouse’s share of the community property without going through the trust.

If the surviving spouse does attempt to give away or sell the deceased spouse’s community property without going through the trust, they may be in violation of the trust agreement and could face legal consequences. In addition, if the trust has a provision for the recovery of improperly transferred assets, an estate litigator may be able to recover that portion of the estate on behalf of the trust and its beneficiaries.

For example, suppose that John and Jane are a married couple in California. They have an AB trust in place as part of their estate plan. When John dies, his share of their community property is transferred into the trust, along with the rest of his assets. However, a few months later, Jane decides to sell their jointly-owned vacation home without going through the trust. She gives the proceeds of the sale to her adult children, believing that she has the right to do so as the sole owner of the property.

In this scenario, Jane has violated the terms of the AB trust by disposing of John’s share of the community property without going through the trust. An estate litigator could be hired to recover John’s share of the proceeds from the sale, which would then be distributed to the beneficiaries of the trust according to its terms.

In summary, an AB trust can be a useful tool for married couples who want to minimize estate taxes and protect their assets. However, it’s important for the surviving spouse to understand that they cannot give away or dispose of the deceased spouse’s community property without going through the trust. If they do, an estate litigator may be able to recover that portion of the estate on behalf of the trust and its beneficiaries.